The Fed Responds to Report that Fed Chair Powell Traded During FOMC Blackout Periods

By Pam Martens and Russ Martens: February 11, 2022 ~

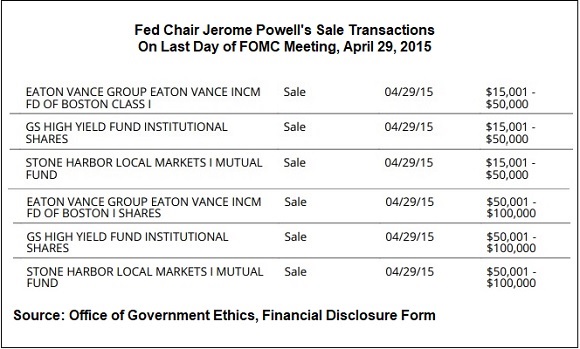

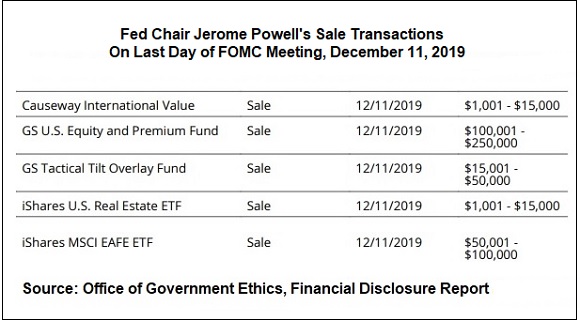

A Fed spokesperson has provided Wall Street On Parade with a detailed response to our article yesterday, which documented that trades were made in accounts in which Fed Chair Jerome Powell had a financial interest during a Federal Open Market Committee (FOMC) meeting in 2015 and another in 2019. Fed officials are clearly prohibited from trading before and during FOMC meetings because that is when they have insider, market-moving information.

A Fed spokesperson has provided Wall Street On Parade with a detailed response to our article yesterday, which documented that trades were made in accounts in which Fed Chair Jerome Powell had a financial interest during a Federal Open Market Committee (FOMC) meeting in 2015 and another in 2019. Fed officials are clearly prohibited from trading before and during FOMC meetings because that is when they have insider, market-moving information.

Below is the full statement from the Fed spokesperson. Following the statement, we will explain its many, serious flaws.

“Chair Powell has not traded during FOMC blackout periods. The transactions that were reported occurred in family trusts over which he had no control. Chair Powell is not a trustee and did not direct or control the trades. He relinquished his previous role as a trustee in 2012 when he joined the Federal Reserve as a Board Member.

“These transactions were regular trades for the purposes of the trust, e.g., raising money for donations under the terms of a charitable trust. The trust is legally required to make certain charitable donations every year. In practical terms, this means that transactions must occur in order to free up funds for those donations.

“The trust financial advisor was advised of our blackout periods and was directed to avoid transactions during those blackout periods. Although they were aware of the FOMC blackout dates, the advisor mistakenly made some transactions during some blackout periods. These transactions were reported as part of his publicly available financial disclosures, which have been available regularly every year since he joined the Board. They are available to anyone through the Office of Government Ethics website, OGE.gov.”

Flaw Number 1: The 2015 trades occurred in “Powell Family Trusts” 3 and 4; the 2019 trades occurred in the “Powell Family Trust 3.” Powell’s financial disclosure forms, which he signed, define what has to be reported under “Part 7, Transactions” as follows: “Part 7 discloses purchases, sales, or exchanges of real property or securities in excess of $1,000 made on behalf of the filer, the filer’s spouse or dependent child during the reporting period.” Thus, Powell or someone in his immediate household had an interest in the assets being sold during two separate FOMC meetings. The assets were not held in Blind Trusts, so Powell – who has a law degree – should have been on top of what was happening in these accounts.

Flaw Number 2: Powell signed an Ethics Agreement in 2017 where he agreed to the following:

“If I have a managed account or otherwise use the services of an investment professional during my appointment, I will ensure that the account manager or investment professional obtains my prior approval on a case-by-case basis for the purchase of any assets other than cash, cash equivalents, investment funds that qualify for the exemption at 5 C.F.R. § 2640.201(a), obligations of the United States, or municipal bonds.”

It follows, logically, that Powell would do the same thing for sales transactions, i.e., give his approval on a “case-by-case basis.”

Flaw Number 3: The statement regarding the need to raise cash to fund charitable donations is not convincing. Many wealthy individuals gift appreciated securities to charity, obtaining a tax advantage in doing so. Regardless, in both 2015 and 2019, waiting one extra day to make the trades would have avoided running afoul of the Fed’s prohibition on trading during the blackout period around FOMC meetings.

Flaw Number 4: Powell signs all of his financial disclosure forms, including those for 2015 and 2019. Why didn’t he notice that there were trades listed that occurred on FOMC meeting dates and issue a timely public apology?

Flaw Number 5: According to the Congressional Research Service, this is the prescribed procedure at the Fed that is supposed to prevent the problems outlined above, as well as those of the three Fed officials that have resigned over their own trading scandals since last September:

“Financial disclosure reports from covered officials, including the original entrance reports and the annual reports filed by May 15, are to be reviewed by supervisory ethics personnel to identify potential ethics and conflict problems, and to resolve any conflict of interest issues that may be raised by the ownership of certain assets by a particular public official. Remedial action which may be required by ethics officials to resolve identified conflicts of interest with respect to certain assets may include divestiture, establishment of a qualified blind trust, procurement of conflict of interest waivers, specific written recusal instruments, and requests for voluntary transfer or reassignment.”

It was not an Ethics Officer at the Fed who disclosed to the public the fact that trades in Powell’s accounts occurred on an FOMC meeting date. It was an activist group called Occupy the Fed.

In fact, the General Counsel and Ethics Officer of the Dallas Fed, Sharon Sweeney, allowed Dallas Fed President Robert Kaplan to trade in and out of “over $1 million” S&P 500 futures contracts from 2015 through 2020. These types of contracts can be used to make directional bets on which way the stock market is going to move. They trade during and after the stock markets in the U.S. have closed – almost continuously from Sunday evening to Friday evening. (See our report: Robert Kaplan Was Trading Like a Hedge Fund Kingpin for Five Years while President of the Dallas Fed; a Dozen Legal Safeguards Failed to Stop Him.)

Supervisory ethics personnel at the Fed also did not stop Fed Chair Powell from having upwards of $25 million of his family wealth managed by BlackRock while the firm was given three no-bid contracts by the Fed.

The Fed is not some mom and pop shop in Dubois. It’s the central bank of the United States with a current balance sheet of $8.9 trillion, 98 percent of which American taxpayers are on the hook for. It’s also in charge of supervising the most dangerous megabanks in the United States, which continue to be serially charged with crimes against the investing public while the Fed continues to bail them out.

Do we really want a man at the helm of this sprawling institution who can’t even own up to his failure to police his own trading activities?