The Congressional Budget Office Is Forecasting U.S. Debt Levels Not Seen Since World War II as GDP Forecasts Dim

By Pam Martens and Russ Martens: August 24, 2021 ~

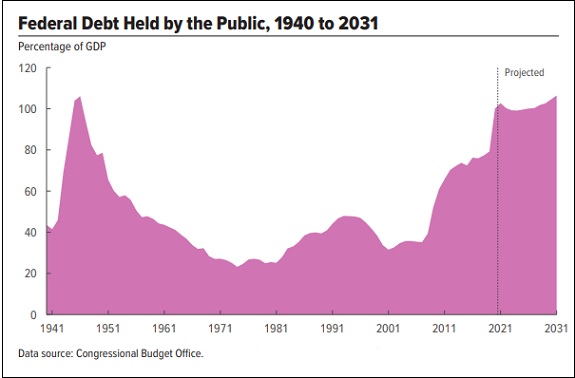

The most recent Congressional Budget Office (CBO) forecast is projecting government debt levels in the U.S. not seen since World War II. According to a CBO report released on July 21:

“After all the government’s borrowing needs are accounted for, debt held by the public rises from $21.0 trillion at the end of 2020 to $35.8 trillion at the end of 2031 in CBO’s baseline projections. As a percentage of GDP, debt at the end of 2031 stands at 106 percent, about 6 percentage points higher than it was at the end of 2020 and nearly two and a half times its average over the past 50 years.”

As for the federal budget deficit as a share of GDP, things aren’t looking good there either according to CBO forecasts:

“CBO projects a federal budget deficit of $3.0 trillion in 2021 as the economic disruption caused by the 2020–2021 coronavirus pandemic and the legislation enacted in response continue to boost the deficit (which was large by historical standards even before the pandemic). At 13.4 percent of gross domestic product (GDP), the deficit in 2021 would be the second largest since 1945, exceeded only by the 14.9 percent shortfall recorded last year.”

Growing levels of national debt and deficits are never good news but they are particularly troublesome when the rosy forecasts for GDP growth this year have started to dim as a result of the economic hit coming from the upsurge in the Delta variant of COVID-19.

On August 19, Goldman Sachs reduced their GDP estimate for the third quarter from a robust 9 percent to 5.5 percent. Goldman Sachs cited Delta’s impact on reduced consumer spending on “dining, travel, and some other services” as the reason for their sharp cut of 3.5 points from their earlier GDP forecast.

The highly respected Atlanta Fed’s GDPNow forecast for the third quarter has also been trending lower, from 6.3 percent on August 2 to 6.1 percent currently. The Atlanta Fed’s GDPNow forecast will be updated again tomorrow, a few hours after durable goods orders for July are released at 8:30 a.m.

The growth trend in the U.S. has had a spate of bad news recently. The Census Bureau reported on August 17 that retail sales had dipped 1.1 percent in July versus the prior month, the second month-over-month decline in the past three months.

On August 18 the downbeat news continued with the Commerce Department reporting that housing starts fell by 7 percent in July to a seasonally-adjusted rate of 1.534 million units versus an upwardly revised rate of 1.65 million units in June. Starts for single-family homes dipped by 4.5 percent to a rate of 1.1 million units. Starts for multi-family housing fell off a cliff, diving 13.1 percent to a rate of 423,000 units.

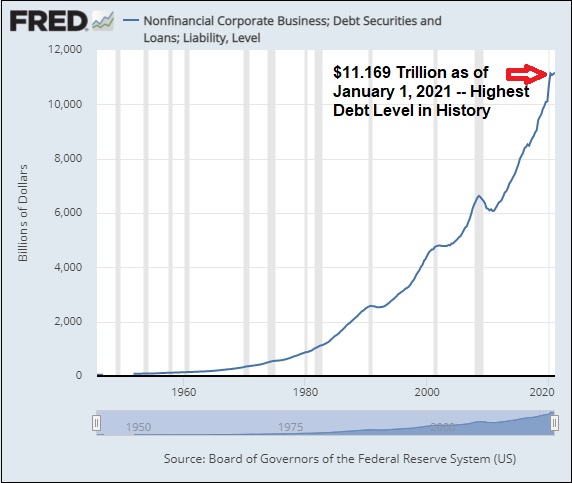

At the same time the U.S. is witnessing a downward trend in economic activity, there is a stark, rising trend in corporate debt levels in the U.S. According to Federal Reserve data, as of January 1, 2021 corporate debt (including debt securities and loans) stood at an historic high of $11.169 trillion. (This excludes debt held by financial institutions.)