Live on the homepage now!

Reader Supported News

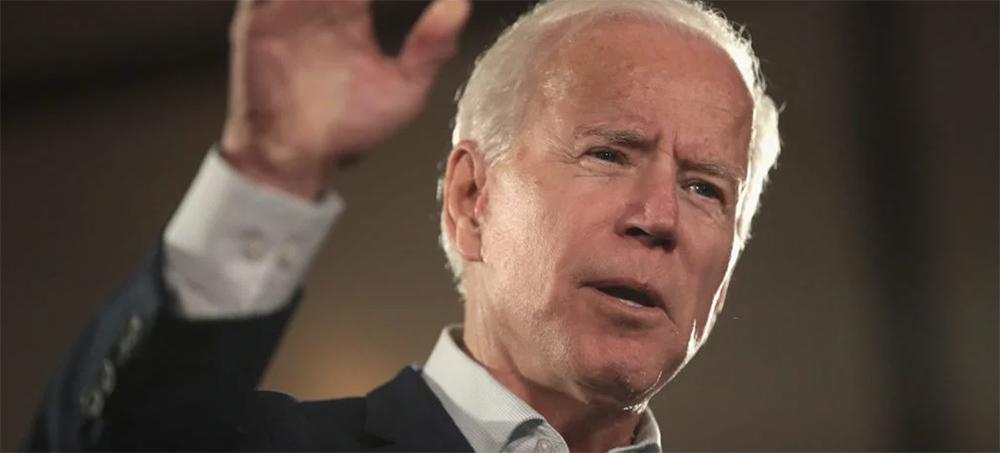

Mostly rich people avoid paying $600 billion a year in taxes, in part through lack of income reporting to the IRS that Biden is trying to change.

Democrats are planning to do something about it. The bill working its way through reconciliation process, which Democrats are using to sidestep the filibuster, includes provisions designed to make sure people pay what they owe; target the wealthy Americans Biden has called “tax cheats”; and close the corporate tax loophole. One approach is to change the IRS reporting requirements, which the Treasury Department estimates would raise $460 billion in revenue over the next decade, to force banks to report customer account information.

The moves are facing opposition. Democrats are reportedly poised to back away from the corporate tax hike, saying that they might include it in another bill. And, in recent months, big banks and financial industry lobbying groups have ramped up efforts to fight the reconciliation package’s enhanced IRS reporting requirements. Republicans — prone to asking how social programs like Biden’s Build Back Better agenda will be paid for — are also lobbying against the tax reporting provisions. Twenty Republican attorneys general sent a letter on October 15 to Biden and Treasury Secretary Janet Yellen opposing the measures.

“We can pay for these game-changing investments in economic growth by asking the wealthiest Americans to pay their fair share,” White House spokesperson Andrew Bates said in a statement. “The fact that Republicans and big banks are bending over backwards to protect wealthy tax cheats who are breaking the law and actively taking advantage of every other American says all you need to know about what’s on the line in this debate over the future of the American middle class.”

Opponents of the reporting requirements argue that forcing banks to disclose gross individual account flows to the IRS would invade individual privacy, put an undue burden on banks, and open up a wealth of data to potential breaches. Groups like the Independent Community Bankers of America, a trade group that represents 5,000 small and mid-sized banks, lobbied against the new reporting requirements by describing the proposal as the “IRS monitoring plan.”

“Banks and their wealthy clients are outright lying about this proposal, claiming that it would give the IRS information on individual transactions,” Senate Finance Committee member Sen. Elizabeth Warren, D-Mass. said on a press call last week with Finance Chair Ron Wyden, D-Ore., to push back on what they called a disinformation campaign by bank lobbyists and Republicans. “And many Republicans are backing them up to satisfy their corporate and wealthy donors. It’s no surprise that those who have billions in unpaid taxes on the line would gladly spend millions of dollars lobbying against this proposal, because it would help un-rig the tax system just a little bit.”

Banks began lobbying in earnest directly against the reporting measures earlier this year, when the proposal was rolled out as part of Biden’s American Families Plan, the first iteration of Democrats’ social spending package. The American Bankers Association, the country’s largest bank lobbying group, sent representatives to Capitol Hill to push back on the proposals.

In August, Sen. Mike Crapo, R-Idaho, ranking member of the Senate Finance Committee, introduced an amendment to stop the IRS from using funds to assess individual account flows and called Biden’s proposal an “outrageous violation of the privacy of American citizens.” He thanked the Independent Community Bankers of America and other groups for backing his amendment, which failed in a 49-50 vote. Crapo has received at least $10,000 this year from banks and industry PACs, including at least two groups fighting the measure.

By September, banking groups’ opposition picked up. The American Bankers Association, along with the Community Bankers Association, the Independent Community Bankers of America, the Mortgage Bankers Association, the Auto Care Association, the National Association of Professional Insurance Agents, and 35 other bank lobbying and interest groups sent a letter to House leadership to express “strong opposition” to the IRS reporting requirement.

Bank of America lobbied last quarter on issues related to “financial account reporting” in the reconciliation package, according to disclosures. JPMorgan Chase issued guidance in recent months instructing bank tellers not to make political statements or explain the reporting proposal to customers who asked or complained about the potential changes; spokesperson Patricia Wexler told The Intercept that the bank did not spend on ads or lobby against the proposed changes and had not urged its customers to contact members of Congress.

In addition to national groups, more than a dozen state banking and industry lobbying groups have also spoken out against the proposal, including a host of state-level chambers of commerce. The Texas Bankers Association said last month it was considering a legal challenge if the reconciliation package includes a “bank surveillance” program. The group launched statewide radio ads against the proposal last month, and spokesperson Carlos Espinosa said it had gotten 40,000 responses so far to its efforts. Several local banks posted the same statement to Facebook last month: “While we typically do not raise issues occurring in Washington with our customers, Congress is considering requiring financial institutions to report detailed information on customer bank accounts to the IRS.”

Banking interest group officials justified their opposition by arguing that the reporting would be too onerous on the banks. “It’s not a function of just adding a few lines on something,” said Paul Merski, an executive vice president at the Independent Community Bankers of America, who claimed new software and staff would be required to implement the changes.

Experts questioned whether the burden for banks would be so high when virtually all banking is computerized. “You’re talking about two pieces of information on a given account. You’re talking about information that the bank already has,” William Gale, an expert on economic policy at the Brookings Institution, told The Intercept. “The objection that this is an intolerable administrative burden seems entirely misplaced to me.”

“If you show me a bank that manages its bookkeeping and accounts by hand, then I will agree that for that bank this would be a burdensome regulation,” Gale said. ”I think it’s much more sort of a reflexive claim on the part of the financial institutions that they don’t want to have to report anything.”

Biden’s proposal is an important piece of efforts to curtail tax evasion, Gale said. “It’s hard to see how policymakers are willing to support the continued high levels of tax evasion that we see.”

Follow us on facebook and twitter!

PO Box 2043 / Citrus Heights, CA 95611